Introduction:

With the rise of blockchain technology, cryptocurrencies have gained immense popularity. One such cryptocurrency is Lither, which can be mined using the Lither app. In this guide, we will walk you through the simple steps to start mining Lither and earning rewards.

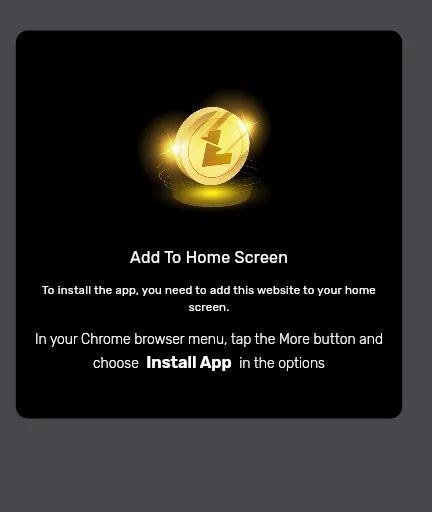

Step 1: Open link https://app.lither.com into your web browser (Chrome) or mobile browser.

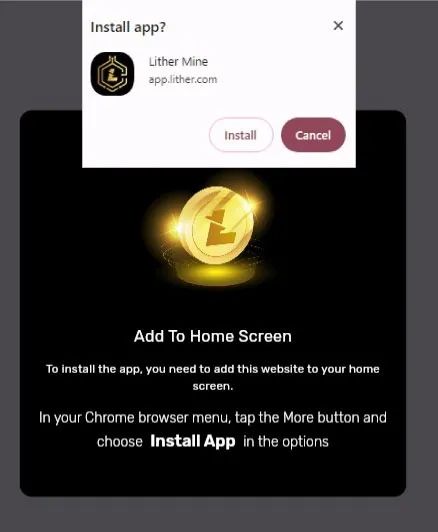

Step 2: Read Onscreen instructions very carefully. Click the 3 dots on the top right corner and Install the application.

Step 3: Opening the App

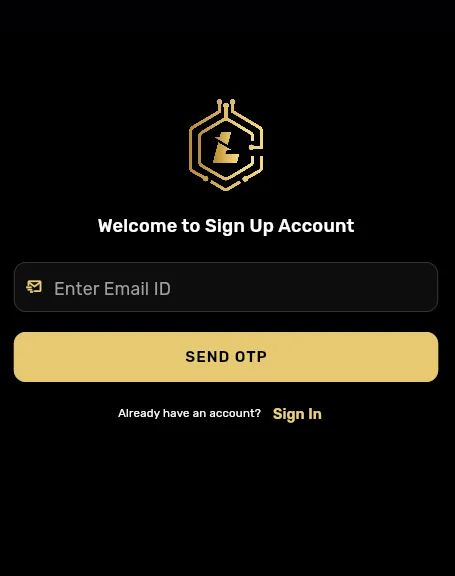

Once you’ve accessed the App,. This will redirect you to the app interface where you can start your mining process. Sign up your account .

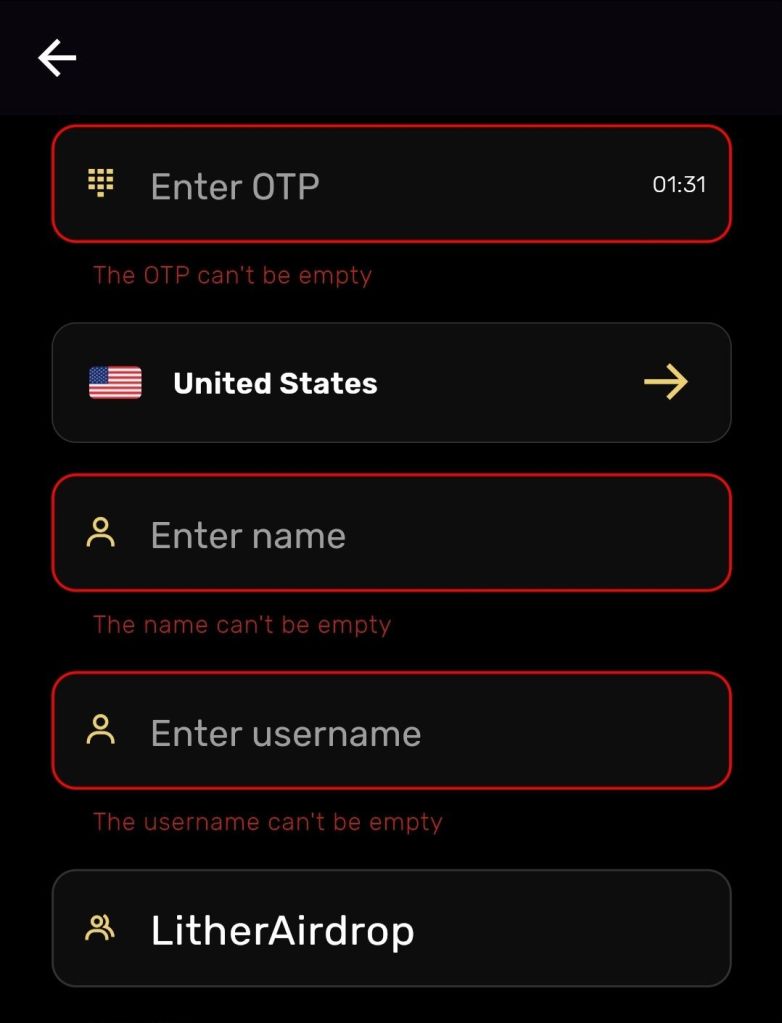

Step 4: Adding Referral Code

Enter Email Id and enter the OTP, you will be prompted to enter a referral code. To proceed, input the referral code “LitherAirdrop” in the designated field.

Step 5: Initiating Lither Mining

After adding the referral code, navigate to the mining section of the app. Here, you will find an option labeled “Tap to mine”. Click on this option to initiate the mining process.

Step 6: Earning Lither Rewards

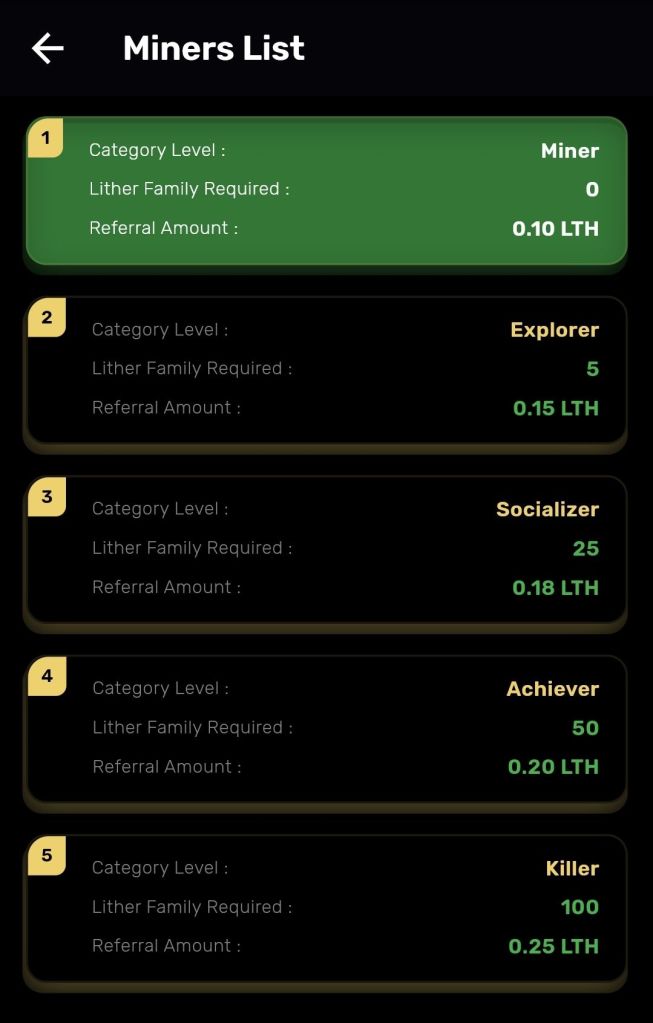

Once you’ve tapped to mine Lither, you will receive 2 Lither as a reward. Keep in mind that the more you mine, the higher your rewards will be. Share this guide with your friends and get more rewards with your referrals.

Step 7: Monitoring Your Progress

To track your mining progress and earnings, the Lither app provides you with a dashboard where you can view your accumulated Lither rewards, mining history, and other relevant information.

Conclusion:

Mining Lither on the Lither app is a simple and rewarding process. By following the steps outlined in this guide, you can easily start mining Lither and earn rewards. So, don’t wait any longer — dive into the world of cryptocurrency mining with Lither today!

🌟 Exciting Opportunity Alert! 🌟

Are you ready to take control of your financial future? Look no further than Robinhood – the ultimate platform for building wealth, investing in stocks, options, ETFs, and crypto, all with zero commission fees! Join Robinhood!